WHICH CARD MACHINE IS BEST FOR YOU?

Take a look at our options below to see which card machine will suit your business best.

FIXED

PORTABLE

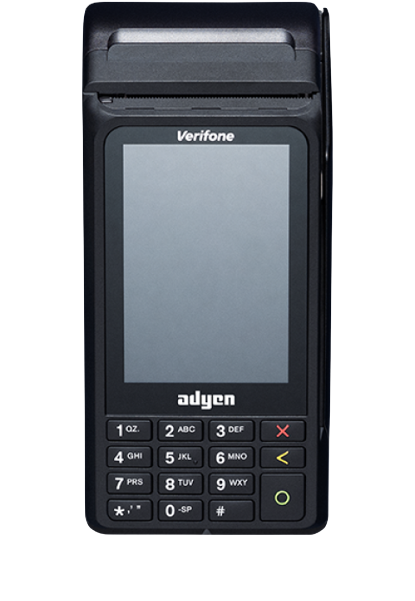

MOBILE

- Plug & play

- Perfect for shops and cafes

- Modestly priced solution

- Compact & lightweight

- Great for the hospitality industry

- Outstanding battery life

- Extremely robust

- Small enough to fit in your pocket

- Pre-installed SIM cards

Tell us more about your business.

You see, it’s all very well offering you what might seem to be the cheapest card machine on the surface but if it doesn’t fit your overall requirements or budget once you start adding the additional fees it’s not the best chip and pin machine for your business.

At ePayment we like to fully understand what your business is about before we offer you a card machine, so it might NOT always be the cheapest solution if you look at the cost of the card machine alone, however we make it our mission to deliver to you the best package that fits your needs.

There are so many variables on what type of card machine works for your business that it’s important for your business that you ask the right questions.

Here are some of the most important questions you should be asking about the card machine that you enquire about…- Do I need a Wifi or GPRS card reader - or both?

- Does the card reader accept contactless payments?

- Would it be better for my business to have a fixed card machine?

- What Card machine manufacturer is best for me, is it Pax, and Ingenico, Castle or Verifone?

- Do I want a card machine with a traditional keypad or a android touch screen?

QUESTIONS TO ASK YOUR BROKER OR ACQUIRER TO ENSURE THAT YOU GET THE BEST SOLUTION FOR YOUR CARD MACHINE

Besides the functionality of the card machine, there are many other questions that any company should be asking you about your business to ensure the best solution is offered to you, below are some great tips for you to ask the correct questions to ensure you are getting the best for your business needs. We have over 12 Acquiring banks that work with us to ensure that the right option is always offered.The authorisation fee is a charge on every transaction and if you run a business with a lot of low value transactions this is a key part of your fee schedule.

Some of our banks offer next day or even SAME day funding, so if cash flow is something critical for your business this is a question worth asking.

These are additional fees added on “customer not present” transactions, so if you take payments over the phone you should be aware of these fees.

Some acquirers charge under a IC++ schedule and some charge under a “ blended” pricing schedule. In a nutshell IC + is a margin that the acquirer adds onto Interchange fees set by Visa and Mastercard. And Blended includes these charges.

Different acquirers have different underwriting timelines, so if time is of the essence then we would 100% recommend talking to us to ensure that you are putting an application in with a bank that can approve you within your expected times.

Each acquirer has different KYC and KYB documents that they require to put forward an application, you will need to ensure that you have all of the correct documentation to put the application in, we can advise you of what is required at the point of discussing the best option for you.

Some acquirers do not charge their merchants PCI, others do and then will charge you a high fee for not being compliant. It’s very important for your business that you understand how to remain compliant.

Businesses are set into risk categories by acquirers and this will be a big factor on where we can place them, we need to make sure you are advised correctly.

Some acquirers settle in Net and some in Gross, this is good to understand as it’s helpful for smaller companies to have the charges taken at course to ensure no nasty unexpected bills.

We deal with acquirers that are located and also all over Europe, if the location is important to you we can advise you of what banks are the correct fit for you also.

These questions are a great place to start to ensure you get offered the best card machine for your business.

If you would like to get the ball rolling by talking to one of our experts please call on +44 7469 753122 and speak to one of our experts who will point you in the right direction to the most suited card machine for your business.

Talk To Our Expert Today

We have helped hundreds of businesses throughout the UK save money on their rates. Book a review today!

Email us

naveed@epaymentsolutions.co.uk

Call us

+44 7469 753122